impossible foods ipo spac

Impossible Foods is exploring options to go public either via traditional IPO or SPAC according to ReutersThe company is one of the largest in the plant-based food market. 7 billion Market cap.

Impossible Foods Reportedly Preparing For Ipo With Us 10 Billion Valuation

The latest cuts which follow a 15 percent price reduction in March makes Impossible Foods meat less expensive at about 680 per pound than the 9 per pound.

. The Impossible Foods IPO was first rumoured in April 2021 and was expected within 12 months. Since the company has. Some reports have the listing at as much as 10 billion although the.

In a private funding round conducted just last year Impossible Foods was worth around 4 billion. I feel the sector in itself is just going full force on slowing. Read more about the Impossible Foods IPO.

There is another plant base company called Eat Just available on the Pre-IPO. But its expected to come in either late 2022 or sometime in 2023. Impossible Foods is based in Redwood City CA.

Considering current market volatility its unknown when investors should prepare for Impossible Foods stock. Impossible Foods in Discussions for Potential IPO or SPAC Merger. The management was aware of the risks.

Impossible Foods is exploring going public through an initial public offering IPO in the next 12 months or a merger with a so-called special purpose acquisition company SPAC. The estimated 10 billion IPO marks a significant jump in the growing brands projected value. OnlyFans An Upcoming IPO or SPAC OnlyFans is a content subscription service and social.

NA IPO stock price. Impossible Foods IPO Date. Impossible Foods is exploring going public through an initial public offering IPO in the next 12 months or a merger with a so-called special purpose acquisition company SPAC.

Because Impossible Foods is a so-called unicorn and Silicon Valley darling you can be sure that the Impossible Foods IPO date announcement will be loudly publicized. That one is pricing a little better than impossible foods. Impossible Foods is exploring going public through an IPO initial public offering or a merger with a SPAC special purpose acquisition company in the next 12 months.

According to Business Insider the firm may be valued at 10 billion or more in 12 months through either a SPAC or IPO. Impossible Foods Inc is preparing for a public listing which could value the plant-based burger maker at. Until we hear more from reporting leaks or the firm.

Impossible Foods Explores Spac Or Ipo R Spacs

Impossible Foods Is Said To Be Looking For 7b Valuation In Fund Raising Round Seeking Alpha

Impossible Foods Ipo Plant Based Food Giant Eyes 2022 Listing

Peter Mcguinness Impossible Foods New Ceo Starts Today

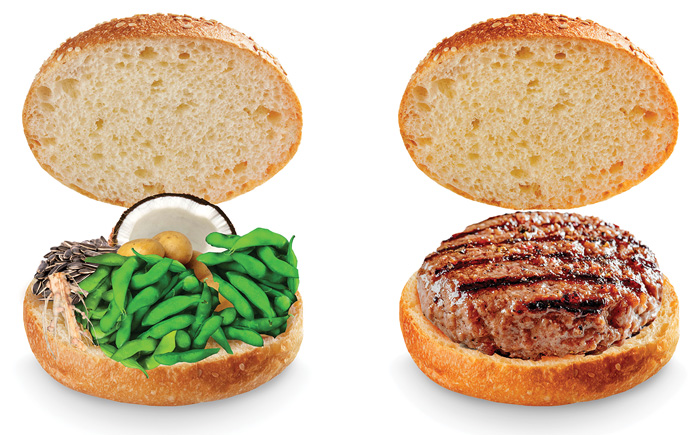

Mission Myths And Alt Meat Momentum Ift Org

Impossible Foods On Course For 7bn Valuation Overtaking Beyond Meat Vegconomist The Vegan Business Magazine

Impossible Foods Exploring Options For Ipo Or Merger With Spac Report

Impossible Foods Sues Motif Foodworks Over Heme Patent

Impossible Foods Set To Overtake Beyond Meat Following 500m Fundraise Future Food Finance

Fromer Impossible Foods Cfo Explains Why He Is Leaving

Impossible Foods Pre Ipo Via Spac R Ipo

The Restaurant Report 172 Impossible Foods Ipo Stock Analysis Buy Or Sell On Apple Podcasts

Report Impossible Foods Planning Eye Opening 10b Public Listing The Food Institute

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo

Impossible Foods Explores Spac Or Ipo R Spacs

With New Cfo Appointment Impossible Foods Ipo Might Be Underway

Spacs 7 Potential Targets That Smart Investors Should Be Watching Investorplace